RDE Capital Group LLC

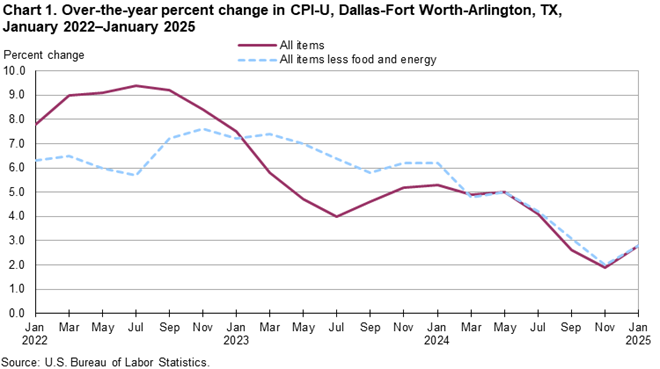

Dallas-Fort Worth Consumer Price Index (CPI-U) Rises 2.8% Over the Past Year

According to the U.S. Department of Labor and Statistics, the Consumer Price Index for All Urban Consumers (CPI-U) in the Dallas-Fort Worth area rose by 2.8% over the 12 months ending in January 2025. The CPI-U reflects price changes based on the spending patterns of most U.S. households.

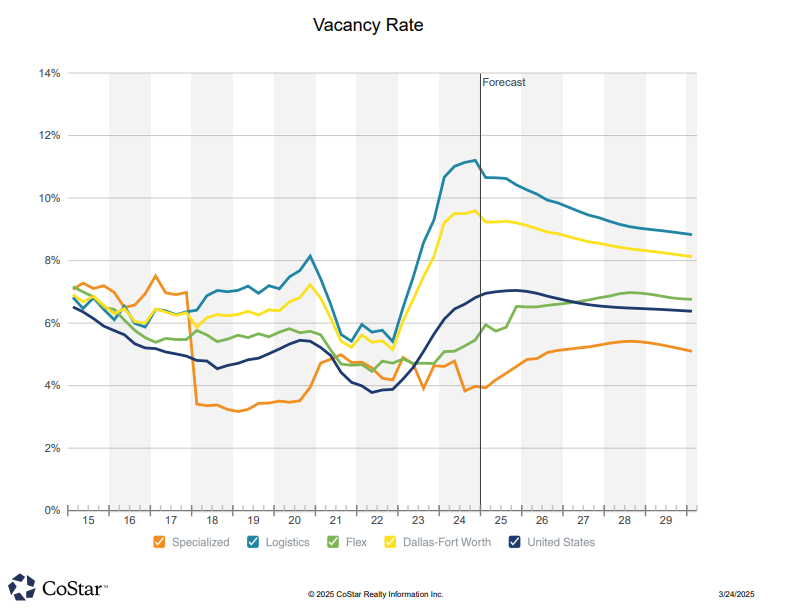

While a 2.8% inflation rate may not be alarming, it adds pressure to multifamily property operators, who are already grappling with a high vacancy rate of 11.1% and negative rent growth of -1.1%, as reported by CoStar Group for February 2025.

Breakdown of CPI-U Changes in DFW (12 months ending January 2025):

Overall CPI-U: +2.8%

CPI-U excluding food and energy: +2.8%

Energy prices: +4.3%

Food prices: +1.8%

Despite moderate inflation, economic challenges persist for the multifamily housing market in the region.

Enrique Arjona CPM®

President l Broker