RDE Capital Group LLC

Dallas-Fort Worth Multifamily Market Continues Shifting Toward Landlord Favorability

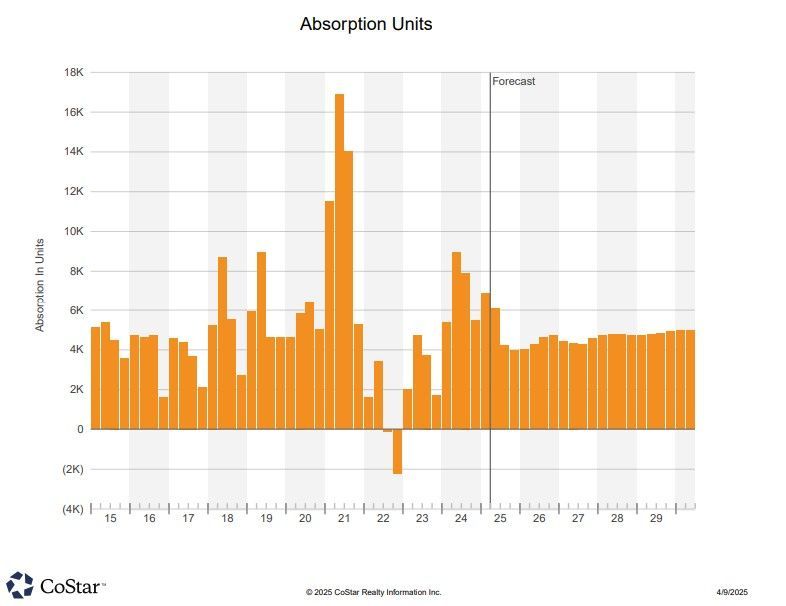

Over the 12 months ending in March 2025, the Dallas–Fort Worth multifamily market saw the delivery of approximately 38,000 new units, while 29,000 units were absorbed, according to Costar Group. This level of absorption reflects robust demand—significantly above the pre-pandemic average of 20,000 units absorbed annually between 2015 and 2019.

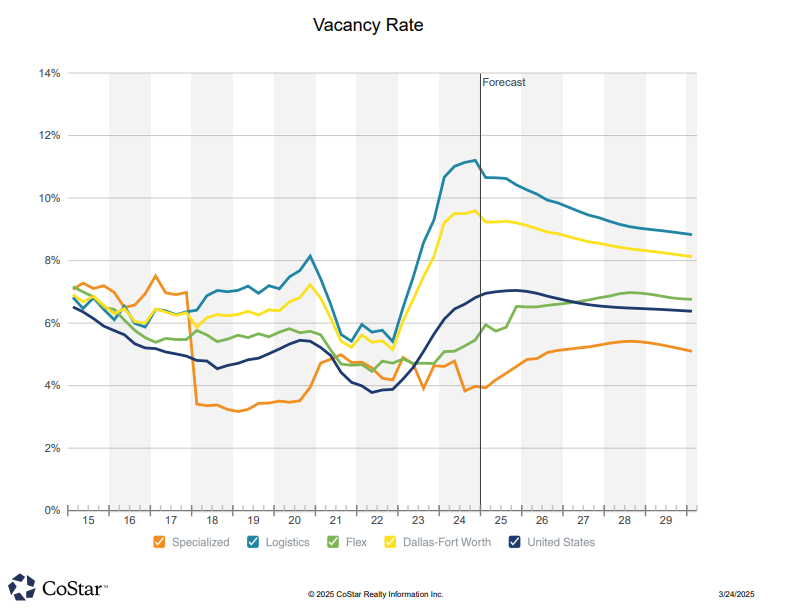

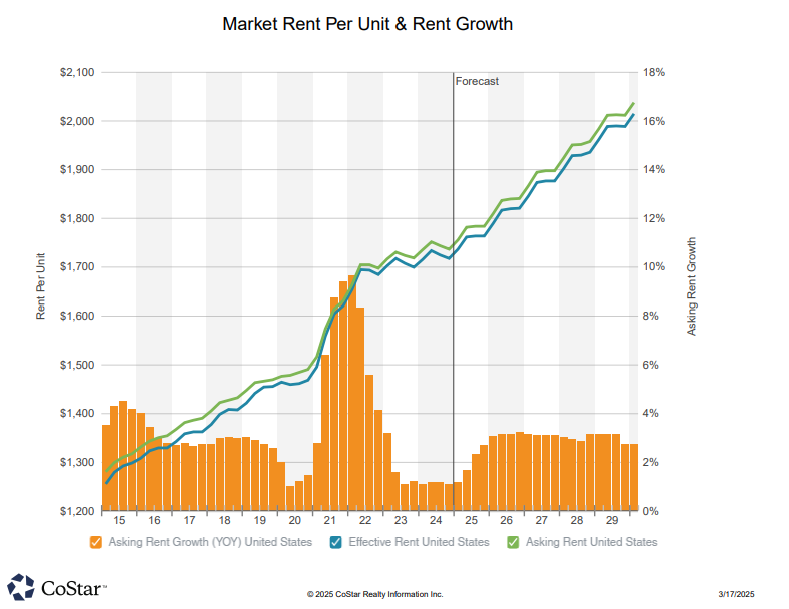

Despite vacancy rates holding at a decade-high of 11.5% and rent growth remaining slightly negative at -0.8%, market conditions are beginning to show signs of a shift toward favoring landlords.

Currently, 33,000 units are under construction—down sharply from the 64,000 units under development in 2023. This substantial decline in new supply, paired with sustained demand, suggests a tightening market.

As absorption continues to catch up with deliveries and construction slows, the DFW multifamily market is poised to tip in favor of landlords by late 2025.

Article Distributed by RDE Capital Group, LLC