Commercial Real Estate Services

JANUARY 2026 OFFICE MARKET UPDATE

Prime Rate

7%

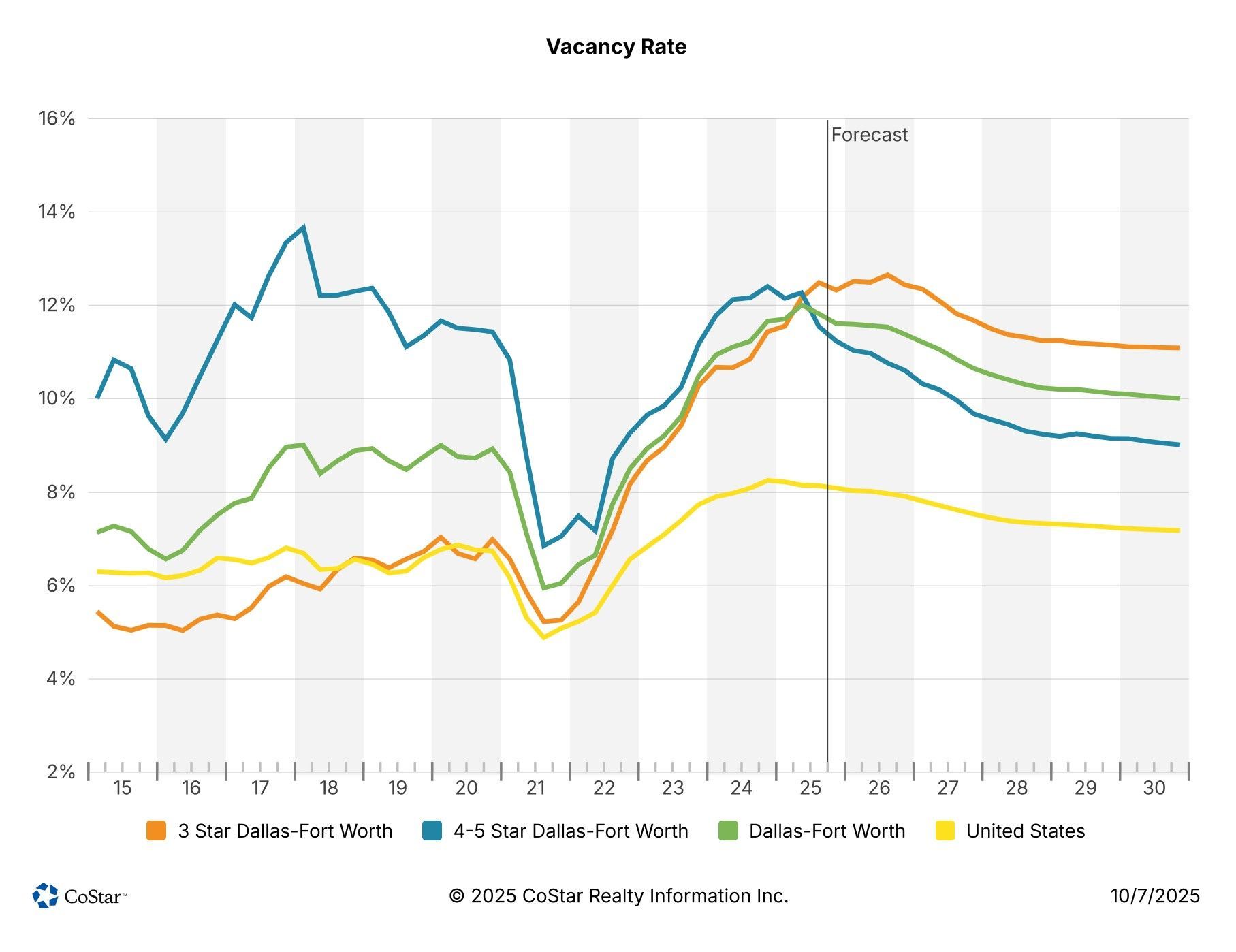

Vacancy Rate

18%

Market Cap Rate

8.5%

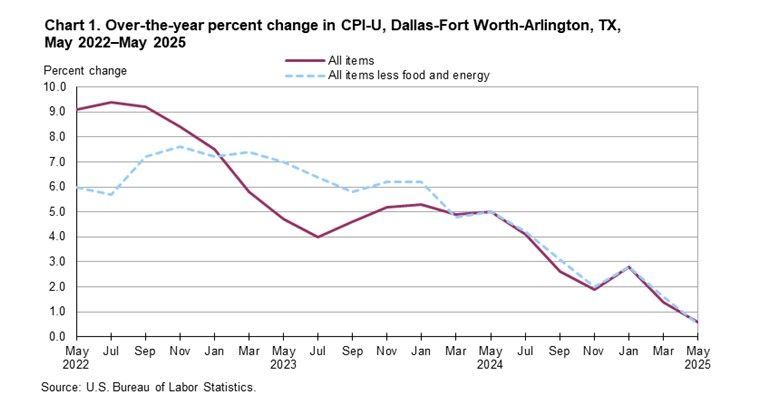

Annual Rent Growth

1.8%

WELCOME TO RDE CAPITAL GROUP

Welcome to RDE Capital Group LLC, a full service commercial real estate brokerage servicing the Dallas / Fort Worth Area. Whether you're looking to sell, buy, lease, or need property management services, our team of dedicated professionals is committed to helping you achieve your real estate goals. If you are interested in learning more about our services, we invite you to view our current listings or contact us through our website, email, or telephone.

Tenants

Owners

Real Estate Brokerage Services

- Buyer representation

- Seller representation

- Tenant representation

- Landlord representation

Property Management Services

- Leasing

- Lease enforcement

- Financial reporting

- Rent collections

- Service request processing

- Unit turns/make readies

Maintenance Services

- Handyman repairs

- Portering

- Landscaping

- Maintenance reporting

- Remodeling/renovations

- Capital Improvements

Our Dallas-Fort Worth Blog