RDE Capital Group LLC

Despite strong demand, Dallas-Fort Worth landlords are competing fiercely for tenants due to an influx of new units.

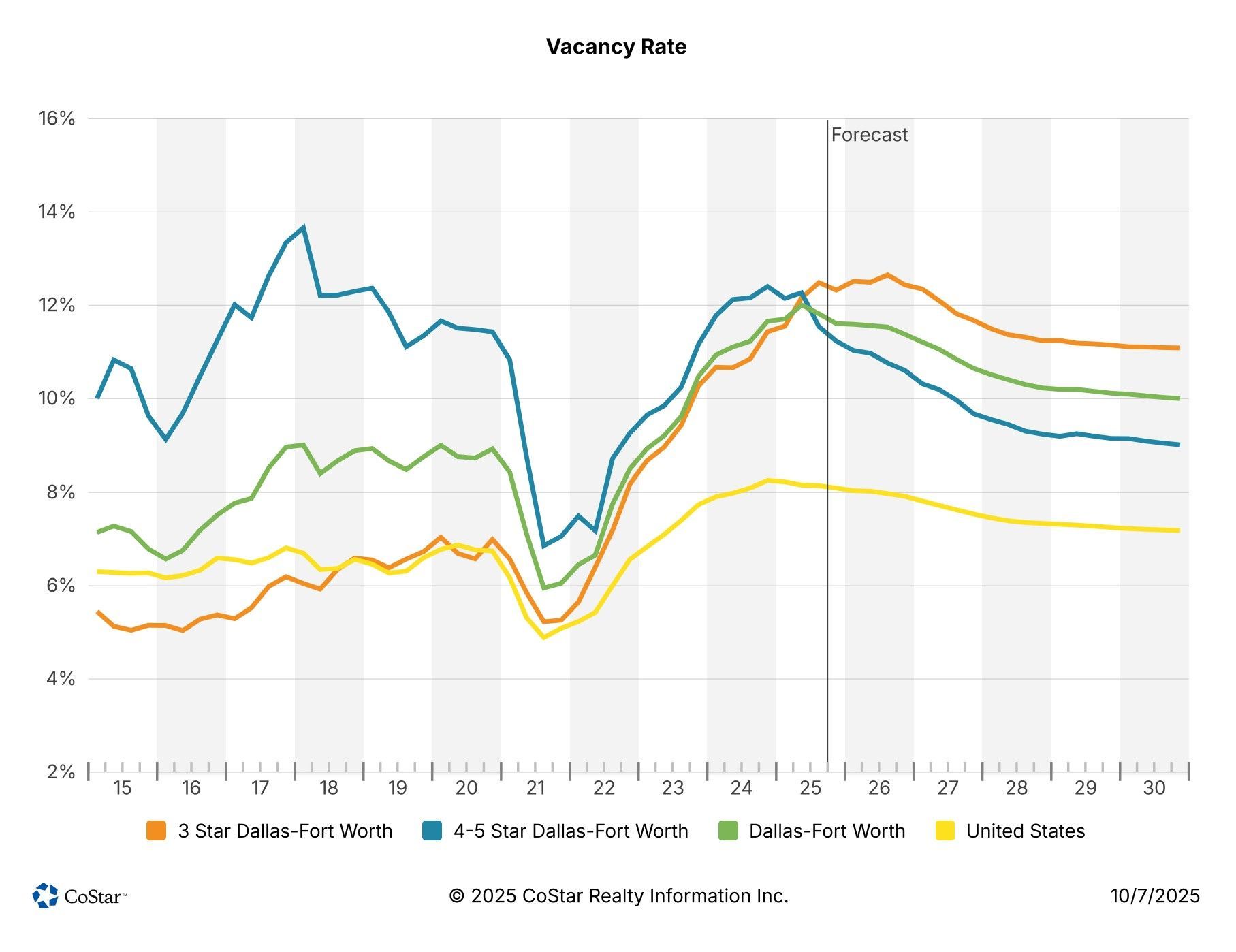

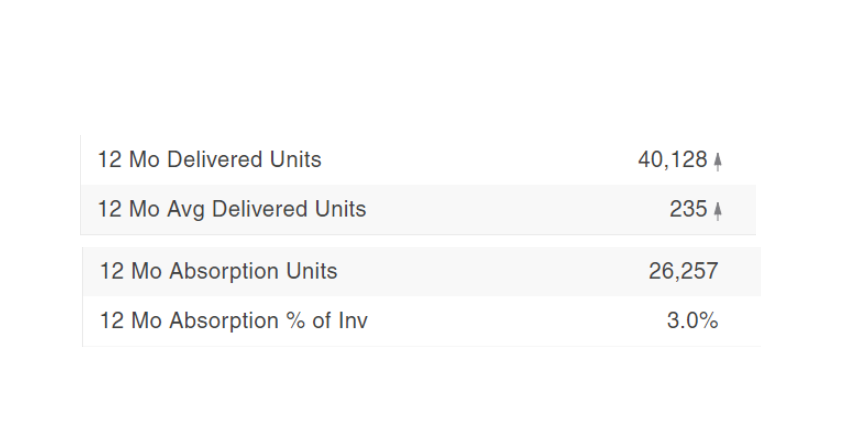

The Dallas-Fort Worth (DFW) multifamily apartment market is currently experiencing robust demand, evidenced by the absorption of 26,257 units over the past 12 months, which notably surpasses the 12,752 units absorbed in 2023 alone. This strong demand is juxtaposed against a high vacancy rate of 10.6%, largely attributable to a substantial influx of new unit deliveries totaling 40,128 in the same period.

With the supply of new units significantly exceeding absorption rates, landlords in the DFW market are compelled to adopt competitive pricing strategies and offer attractive concessions to prospective tenants. This approach not only aims to fill vacancies but also to retain tenant interest in a landscape characterized by abundant choices.

As the market adjusts to these dynamics, observing how landlords navigate pricing and concessions in response to ongoing demand and increasing vacancy rates will be crucial. The balance of supply and demand will continue to shape the market conditions, potentially influencing future development plans and tenant retention strategies in this fast-growing region.

September 6, 2024

Source: CoStarGroup