RDE Capital Group LLC

Dallas/Fort Worth Multifamily Vacancy Rate Remains Elevated Despite Strong Demand for Apartments

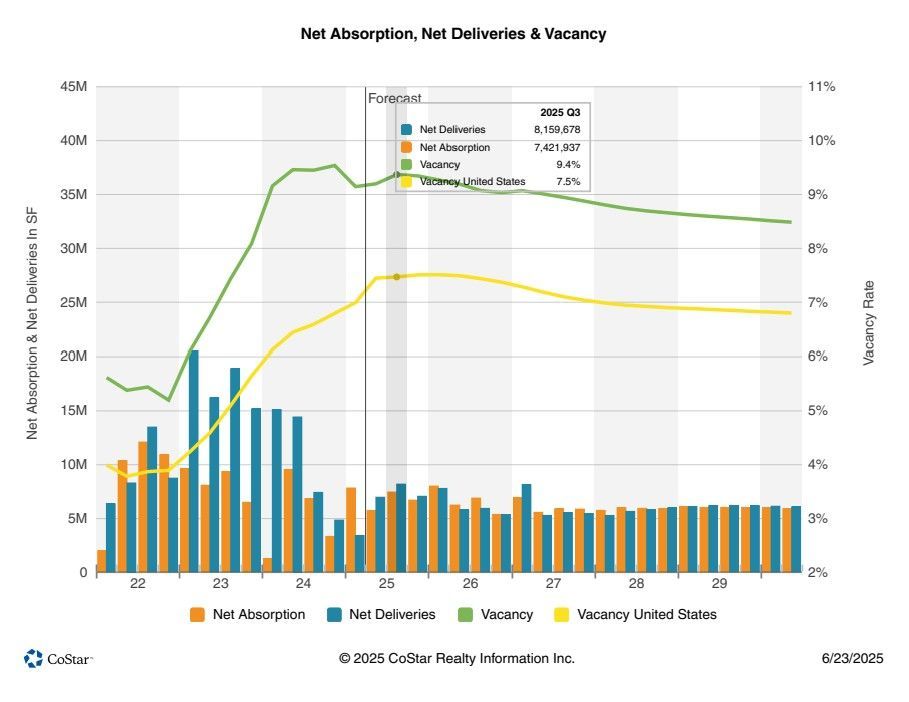

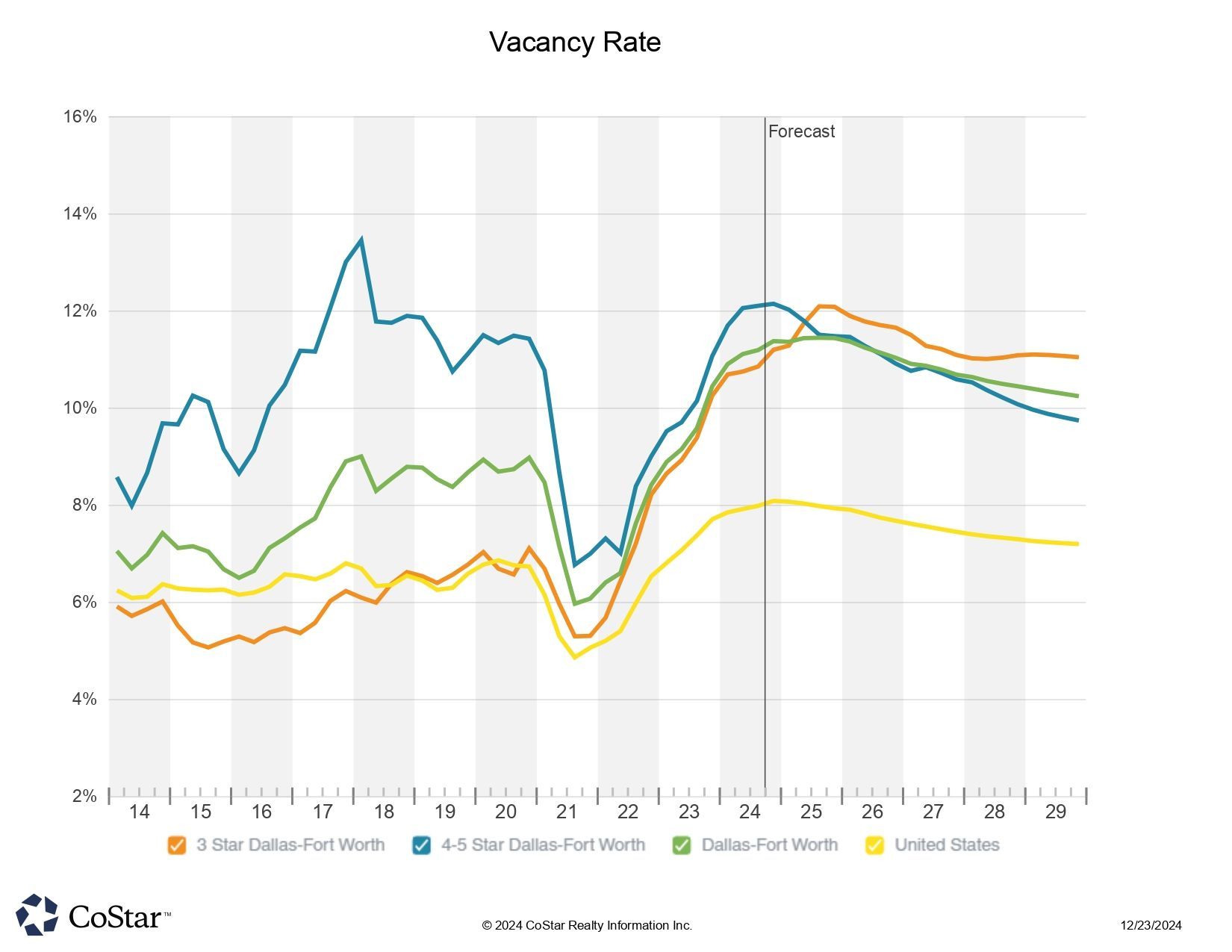

As of December, the multifamily vacancy rate in the Dallas/Fort Worth (DFW) market stands at 11.3%, significantly higher than the 10-year average of 8.3%, according to Costar Group. This elevated rate can largely be attributed to a substantial oversupply of rental units, with developers bringing approximately 42,000 new units to the market in the past year alone.

Despite this high vacancy rate, demand for apartments remains robust. Net absorption—the number of units leased minus the number of units vacated—reached 29,000 units over the same period, indicating a strong appetite for housing even amid increased supply.

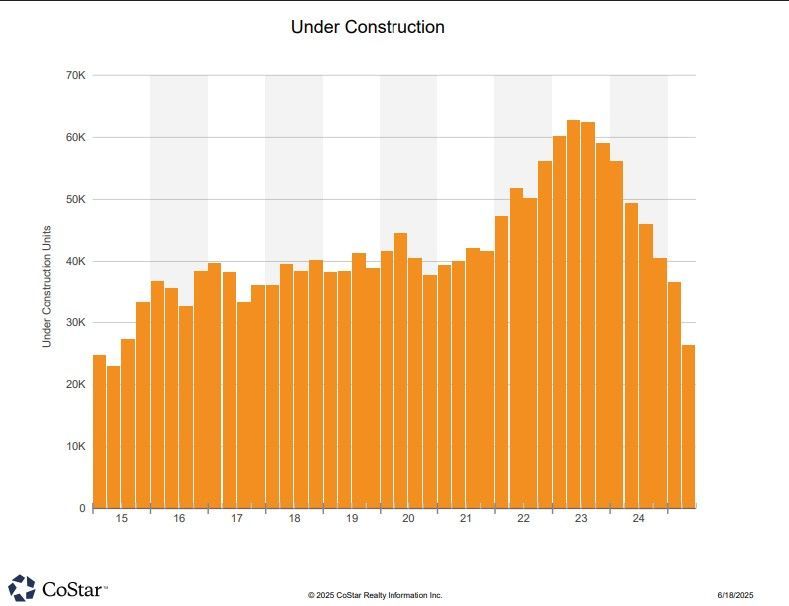

Looking ahead, approximately 37,000 additional units are currently under construction, expected to be delivered throughout 2025. This influx is likely to keep vacancy rates elevated above the historical average for the foreseeable future. However, with construction financing costs remaining high, we anticipate a potential reduction in new developments, which could lead to a gradual decline in vacancy rates toward the end of 2025 and into early 2026.